why get a cash advance

Yet not, it is strange for first-go out homeowners to possess that much dollars

Checking out the brand new Dining table

Because found on dining table, the advance payment commission notably impacts the latest monthly homeloan payment. Which have the lowest 5% off, the commission is focused on $step 3,160 per month. But with a massive 30% down-payment, the new month-to-month pricing minimizes significantly to around $2,328.

An alternate key that’ll alter that it relationships ‘s the mortgage interest rate. In the event the prices go up, new payment per month for each and every circumstance do increase. In contrast, when the cost drop, costs usually fall off.

When you need to pick a beneficial $five-hundred,000 home, your income is not that highest, then you will need a big down payment. High off repayments much more preferred to have second otherwise 3rd-big date homeowners.

How much Normally step 1% All the way down Desire Save?

Rates of interest will always altering. Once the industry changes and you may costs beginning to drop, it’s beneficial to thought just how much a reduction in interest rate can affect your own payment.

Let me reveal an assessment desk indicating the newest monthly installments to own a beneficial $eight hundred,000 financing at some other interest rates over a 30-year several months:

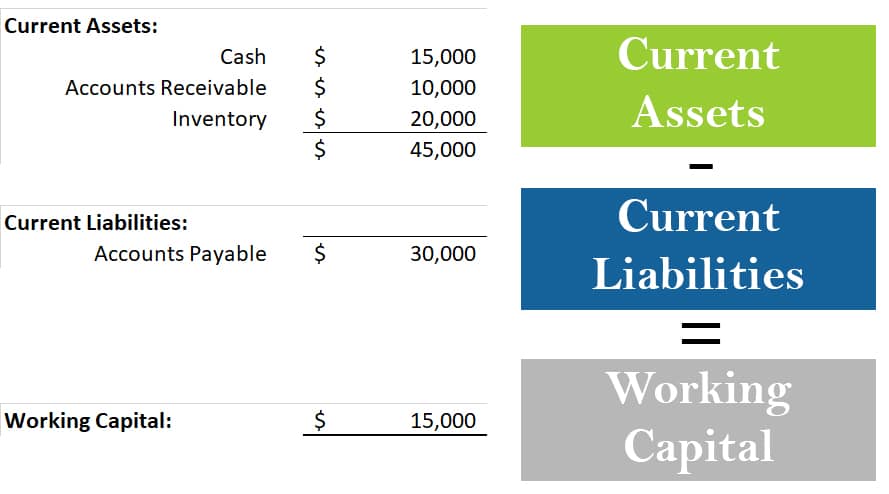

This table depicts how your deposit amount, in combination with your own interest, gets the greatest effect on Recommended Site the month-to-month will set you back as well as how much you could be eligible for.

When assessing how much earnings you really need to pay for an excellent $five hundred,000 household, you ought to earliest figure out an approximate downpayment and you will interest.

Additional Will cost you to look at

Homeownership includes even more can cost you on top of a month-to-month mortgage fee that foundation toward houses cost. Homebuyers as well as their mortgage brokers must also think property fees, homeowners insurance, repairs costs, utilities, or any other potential unforeseen expenses.

Possessions Taxes and Homeowners insurance

It’s not hard to notice entirely towards the home loan number when budgeting to possess a property. But do not neglect property taxes and you will insurance premiums.

Possessions tax rates assortment by county; to the average U.S. overall, the fresh new productive property tax rate is 1.10% of your home’s examined value. Yet not, many states, eg Colorado, has actually much higher possessions tax rates. Make sure to finances accurately into property fees of domestic you order.

Homeowners insurance cost depend on factors for instance the place and decades of the house. Research rates to help you estimate such will set you back just like the can cost you will vary because of the vendor. Just remember that , elements at the mercy of flooding or wildfires could possibly get need extra insurance coverage.

Fix or any other Costs

The costs from homeownership usually do not avoid after you’ve bought a house. Despite relocating, houses have debts to spend and you may fix needs that need budgeting. Regardless if you are thought a restoration or perhaps not, its imperative to reserved funds to own repairs.

Experts recommend so you’re able to funds up to 1% out of a home’s complete value a year to own repair and a lot more to own more mature functions. That means if you find yourself to acquire an excellent $500k domestic, you need to reserved at least $5,000 per year to possess fix and you can unexpected expenses.

Because the mortgage becomes your right in front home, practical budgeting for the more will set you back of control is actually an very important section of being a happy homeowner. Your real estate professional may help review an entire image.

To make a good $500k Family Sensible

To shop for a great $500,000 residence is a major financial commitment. Very, exactly what income want to conveniently afford a property during the so it budget?

Because a tip, you need to spend just about twenty eight% of the terrible monthly income to the casing and no over 36% towards personal debt servicing. That means that although you can be be eligible for a loan which have as much as a 43% DTI, it is not needed.

In the present weather, the money required to get a great $five hundred,000 household varies predicated on private finances, deposit matter, and you can interest rate. However, incase market rates regarding 7% and you may a great ten% downpayment, family earnings would have to end up being on the $128,000 to purchase an effective $five-hundred,000 domestic. However, the amount of money required transform in line with the down-payment and you can notice rates.