cash america advance loans

What exactly is a profile Financing and just how Does it Performs?

Remember our very own composing team like your Yoda, that have pro money advice you can trust. MoneyTips demonstrates to you axioms merely, rather than features or foregone conclusion, so you can alive your very best financial lifetime.

Talk about The Home loan Alternatives

A profile financing, also known as a portfolio home loan, was home financing your financial (such as for instance a lender, borrowing commitment or on the web financial) has into the-household with its own mortgage portfolio. Because of this the financial institution both starts and maintains the borrowed funds in the place of attempting to sell they into supplementary sector.

Extremely mortgage loans ended up selling are old-fashioned (or compliant) mortgage loans. That is, it conform to your credit conditions lay because of the Fannie mae and you may Freddie Mac computer. But Memphis savings and installment loan a lender would not sell a portfolio mortgage, therefore, the bank is put its very own conditions. Like that, people who may well not be eligible for a traditional mortgage loan may be able to nevertheless score a mortgage.

Exactly why are mortgages marketed?

Really mortgage brokers can not hold a limitless number of personal debt to the the books and need investment they may be able following provide some other borrowers. Generate liquid capital and continue maintaining lending, a bona-fide estate financial will sell your own mortgage on additional industry.

Just how perform mortgages score offered? Always, mortgage loans was bundled along with other mortgages towards a financial plan named a mortgage-recognized safety. Federally recognized people Fannie mae and Freddie Mac are a couple of away from the top dealers one to buy mortgages. They do this to store the bucks flowing on the mortgage community so more individuals should be able to money and own belongings.

Have a tendency to offering a home loan impact the borrower?

Attempting to sell home financing will not change the regards to the mortgage to have the debtor. The single thing one possibly change is the fact that the borrower could possibly get have to posting the month-to-month homeloan payment to some other financial servicer.

Borrowers Who’ll Make the most of Portfolio Money

Portfolio finance may benefit borrowers because lender is place the fresh borrowing criteria instead of conforming to standards put from the Freddie Mac and you will Fannie mae. Several problems in which a debtor you certainly will benefit from a portfolio loan more a conventional financial is:

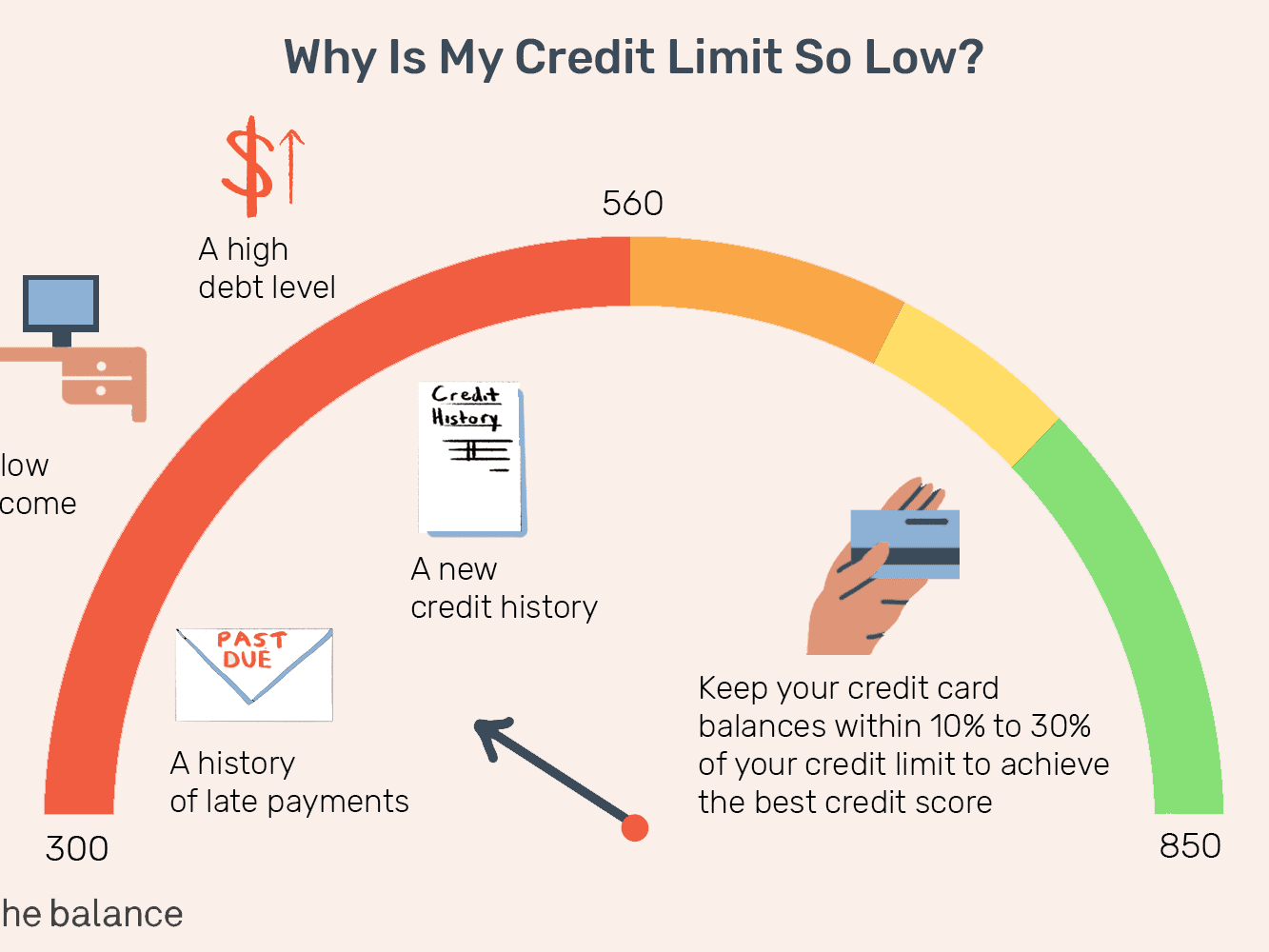

- Consumers which have a poor credit get otherwise highest DTI: Appropriate over time of unemployment or another disease one to briefly derailed their profit, leading to numbers which do not see conventional mortgage criteria

- Large earners which have reasonable credit ratings: To own borrowers that has a premier-purchasing jobs, but have situations while making monthly premiums timely.

- Self-operating otherwise self-employed individuals: A debtor possess an adequate credit rating and you will assets, however, you are going to lack regular money. A collection mortgage could be an option, or the borrower you will imagine a bank declaration mortgage.

- A beneficial consumers of one’s bank: Often, a lender simply render a portfolio financing on the better, best consumers, or to some one they would like to features a far greater reference to, including a neighbor hood entrepreneur.

- People who want a bigger loan: When the a debtor needs a larger loan amount than simply it be considered for or needs a mortgage bigger than an effective jumbo mortgage, a profile financing might possibly be a choice.

Benefits of Collection Finance

- Approval cost: A portfolio financial tends to be so much more lenient within the giving mortgages. Including, the borrower might not have to get to know standards to possess at least down payment, hold priI) having an inferior deposit, loan constraints otherwise the very least credit rating.

- Flexible conditions: The lending company normally personalize the borrowed funds to your borrower’s need which have individualized conditions including bimonthly costs or good balloon commission. The lending company might also allow it to be a borrower to invest in far more qualities than simply will be allowed which have a normal mortgage.

Drawbacks out of Portfolio Fund

- Large interest: Mortgage cost become large to have portfolio loans to compensate towards the risk the lending company should neck by having the brand new financing on the books.

- Fees: The lending company is almost certainly not to make as frequently currency toward collection loan because they manage with antique mortgage. So, the newest profile lender may charge large charges, for example a top prepayment payment, and also make right up a few of the distinction.

The way to get a profile Financing

Portfolio finance are difficult to get as they are basically unadvertised. Plus the mortgage requirements would be much easier or higher strict, since they’re to the lending company. Exactly how, up coming, is actually a borrower designed to rating a portfolio financing? Here are some tips towards the interested in a profile financial:

Are a portfolio Financing Right for you?

With a bit of bit of legwork, you might be capable safer a profile mortgage loan. Be sure to manage leading, legitimate loan providers and keep on top of your money making them because strong that one can.