advanced america cash advance

What’s the Reasonable Acceptable Credit score to have a consumer loan?

Getting an unsecured loan always demands a credit assessment, which means loans Placerville CO your credit score is essential. While you are loan providers will vary in their criteria, you’re very likely to get the best financing conditions in case your score is in the “good” group or higher, definition no less than 670. However, even though you have only a good “fair” get, and that starts at 580, you might be able to receive a personal bank loan from particular lenders.

Secret Takeaways

- Loan providers set their minimal fico scores for personal money.

- Overall, a score from 670 or over commonly entitle that the fresh best interest pricing or any other terms.

- Particular lenders offer unsecured loans to help you individuals having lower ratings, even if constantly at quicker favorable terms and conditions.

- In case the credit history isn’t satisfactory, there are ways to improve they.

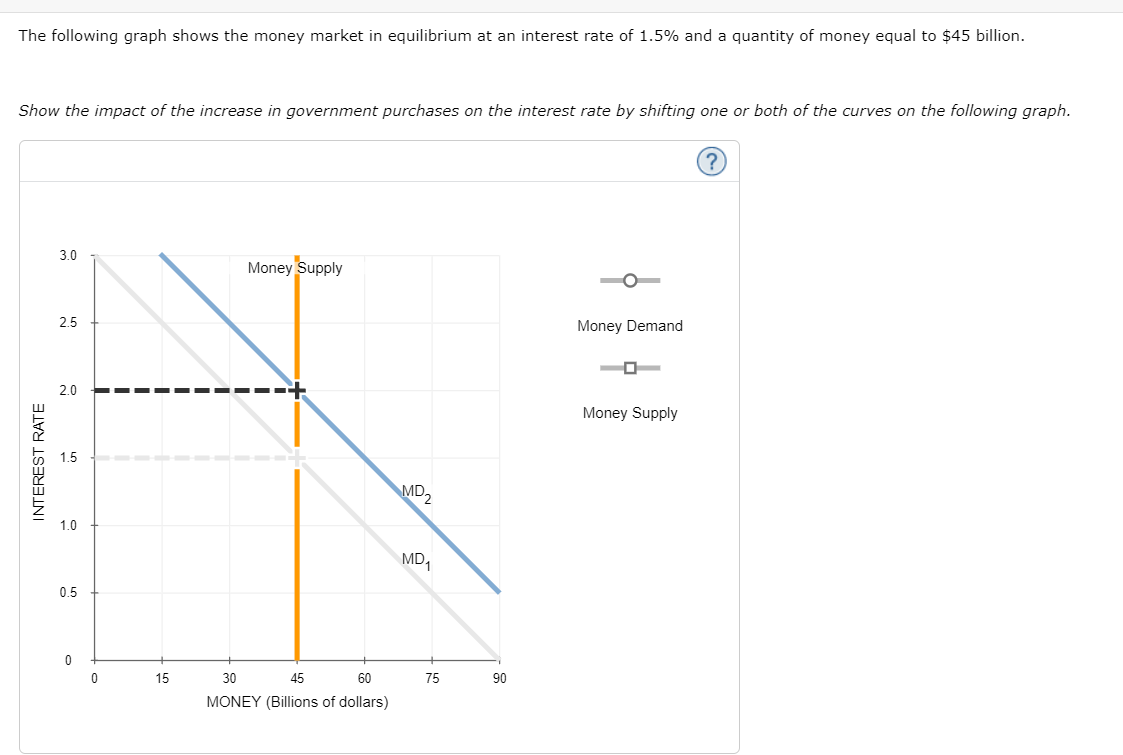

Exactly how Credit ratings Really works

Once you submit an application for financing and other type of borrowing from the bank, the lender has a tendency to look at each other their credit reports and you will credit rating inside determining whether to accept the application and you can, therefore, exactly what terminology to provide. That can include the rate of interest you are going to need to shell out.

One particular widely used credit ratings was Credit ratings. They rates your own understood creditworthiness with the a scale of 300 in order to 850. FICO’s major competitor, VantageScore, uses that exact same size.

Your credit score isn’t included in your own credit history but is according to the recommendations. The 3 fundamental credit agencies (Equifax, Experian, and you will TransUnion) discover suggestions from the loan providers and you can secure they for the an individualized breakdown of you. Your own get you will differ somewhat dependent on and this company or firms creditors are accountable to.

- Payment background (35%): This category boasts whether you create the borrowing repayments punctually and you can shell out at the least minimal amount.

- Numbers due (30%): This category not merely investigates just how much you borrowed from within the complete also just how much of one’s available revolving borrowing from the bank you’re using at any given time, named the borrowing from the bank application proportion. Generally, the reduced the proportion, the greater.

- Amount of credit rating (15%): The length of time you have got borrowing from the bank, also the chronilogical age of specific levels. Earlier is most beneficial.

- Borrowing merge (10%): These kinds takes into account the different form of credit your has actually, including payment money (like personal loans) or rotating credit (eg credit cards). To possess credit rating intentions, it is good to have significantly more than you to definitely type.

- The brand new credit (10%): Starting plenty of profile during the a brief period of your energy you may negatively apply to your credit score. Lenders usually takes one to help you imply that you will be financially overextended otherwise on course for the reason that guidelines.

Consumer loan Options for Reasonable otherwise Less than perfect credit

While you’re prone to get a better interest rate having a high credit score, will still be you’ll be able to to get a personal loan when you yourself have reasonable (or sometimes even bad) borrowing from the bank.

The following ranges, throughout the credit agency Experian, can supply you with a concept of when your credit is regarded as an effective, fair, otherwise terrible:

If for example the borrowing from the bank is at the very least fair, discover a high probability that you’ll be able to get a beneficial personal loan, as long as you don’t have extreme most other personal debt and you will are willing to shell out a top interest.

You to definitely choice is to test having a cards commitment, for folks who belong to one to, to find out if it has got reasonable- or bad-borrowing finance. Another type of is to find a loan provider that can material you an unsecured loan for those who set-out guarantee (a secured loan). You might be able to find a loan provider that will let you take out financing having a beneficial co-borrower otherwise co-signer having a good credit score.