advance america cash loan

Tips Money Multifamily Belongings which have a beneficial Va Loan

The current Coronavirus pandemic makes a great amount of questions regarding the effect on the genuine property ily purchasing can offer a good reprieve out of financial disturbance for real property investors. The reason is that multiple-family relations functions bring faster exposure because of with several tool.

The majority of people don’t discover-is that you can buy multiple-household members properties which have a good Virtual assistant Financing. It’s an amazing opportunity for seasoned investors otherwise basic-big date homebuyers, so be sure to don’t ticket it!

Multifamily Homes Browse and Data

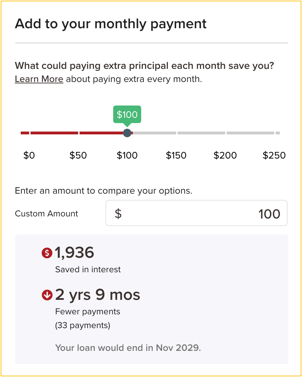

When you are researching functions to purchase, understand their will set you back! Their home loan repayments include dominant, notice, taxes, and you can insurance, but that’s only a few you should envision. It is essential to have situations for example tools, projected fix can cost you, vacancy, resource expenses, and you may property administration. With more than one equipment setting a boost in each of these types of!

You need to know your possible rents. This will help your (along with your bank) know if its a good buy. Place is a huge cause of leasing numbers, therefore make sure to look places.

Basic, to invest in a multi-relatives property which have a good Virtual assistant loan, the debtor need to take one of many products within this two months of closing. This is actually the same code you to definitely relates to unmarried-members of the family property. Even if you are required to survive the house or property, a chance is dependant on renting from kept systems to pay for their mortgage payments.

When there is one experienced borrower, the house can simply has actually doing four devices. Very, if perhaps you were contemplating performing an excellent Va loan to possess a good 100-device flat advancedthat is not you’ll, but there is a means to add more systems. That with a shared Virtual assistant Financing, a couple of experts can find a property to one another. Because it is two individuals, the fresh Virtual assistant makes it possible for half a dozen complete units. This consists of five residential units, one providers device, and another device that’s mutual ownership.

For each the norm, this new Va necessitates the property to generally meet lowest assets requirements to feel financed. Such minimum assets conditions ensure that the property is as well as livable. One of those criteria is the fact each tool need to be private and you will available. Shared h2o, sewer, energy, and you may energy is ok given:

- The house have separate service shut-offs per device.

- Discover easements/covenants securing h2o connectivity and loans La Fayette AL you may Va approves of these agreement.

- Make sure the systems enjoys legitimately safe the means to access utilities to own repairs (though its passageway through-other livings spaces).

- Mutual room eg washing and you can stores are allowed by the Virtual assistant.

Va Application for the loan Process for buying Multifamily

Although processes is going to be exactly like using a beneficial Virtual assistant loan for purchasing one-family home, there are many variations. Instead of solitary-members of the family, the latest Va can allow rental income off empty gadgets is believed, you need certainly to establish:

- Which you, the new borrower, are an experienced property manager/movie director on one of those standards:

- You really must have possessed multifamily in past times.

- You have got earlier in the day experience handling multifamily.

- You have got early in the day experience event possessions accommodations.

- You’re in the past used for people possessions character.

Once you have given related paperwork to show among the many a lot more than positions, new Va commonly apply 75% out-of future rental earnings for the full money idea. To utilize upcoming local rental income, signed renting should be in place ahead of closing the borrowed funds.

Other Considerations When selecting Multifamily Residential property with a Va Financing

Although the cost of a multiple-product check tends to be enticing to successfully pass to your, consumers should have a check complete for the property throughout escrow. Having a review deliver information about any problems with the newest property, that will help you make an informed decision on your get and may even assistance to price/contract discussion.

With your Virtual assistant loan buying a multi-family relations home is a start otherwise addition to the using travel. Once you Pcs to another obligation route, you can rent all the systems to produce extra money. You might quickly create your collection and just have quicker financial chanceits an earn-victory!

Kelly Madden was an air Push partner currently stationed at Yokota Abdominal, Japan and has now already been hitched in order to their particular great spouse, Rich, to have thirteen years. This woman is and mother to three beautiful girls Ava, Lexi, & Evie. An authorized Fl agent (currently for the recommendation condition), she and her partner individual about three rental qualities during the Crestview, Florida and they are operating towards cracking towards multifamily stadium. Kelly loves to spend their time being employed as a virtual secretary, volunteering while the a button partner to own 5AF, and horseback riding.