legit no credit check payday loan

Mortgage brokers to possess Coaches, Firefighters, Unmarried Moms and dads, etc

A few homebuyers is fortunate being buy real estate with dollars. For many people, this is not a practical alternative. Most homebuyers check out loans their property orders having a home loan loan. They often spend a deposit and you will finance the bill because of the making month-to-month mortgage payments towards the financial of its options.

The sort of financing that you find hinges on the own individual needs. Loan providers will take a look at your a position and you may credit history before making a decision whether to give the loan request. Certain teams, like instructors, firefighters, earliest responders, single moms and dads and you may army participants s and you may coupons.

To shop for a house when you look at the Ca isn’t an easy task. You’ll want to pay attention to current market manner and you may monetary conditions. This can help you to determine when you find yourself for the https://paydayloancolorado.net/two-buttes/ a buyer’s field or good seller’s markets. Even after an offer might have been approved, there might be unanticipated trouble or waits which will lengthen the method. Persistence, time and energy, and a proactive course of action can help you change your desire home ownership towards reality. Having said that, check out fascinating loan options for teachers, firefighters/very first responders, single moms and dads, and you can armed forces team:

Ideal mortgage brokers to own coaches

step one. Good-neighbor Nearby. This option is made available of the Joined States’ Institution from Property and you may Metropolitan Creativity (HUD). It’s meant for civil servants also instructors and you will teachers. Individuals you’ll qualify for an economy for up to half of one’s list price getting a house in the elements which can be earmarked to own revitalization.

A hushed second mortgage is added of the HUD on the sorts of possessions which is ordered. Since client features met the 3 season residence criteria, another home loan is then increased. Homeowners simply need matter themselves into the fundamental home loan which was taken out on the home.

2. Teacher Next-door. Professor Nearby can be acquired to instructors and you may personal servants. They could be eligible for certain savings on the numerous charge for the household profit purchase. This method can also be used in conjunction with a conventional financial from organizations such as for example Freddie Mac or Fannie mae.

A free house appraisal, no broker otherwise loan application fees, lower identity fees and you can loan interest levels, deposit direction and you can has are among the pros you to this method will bring. Applicants could possibly get seek people or all of the incentives and you may offers that exist. Those who utilize this solution have to discover a debtor in their community and you can run an instructor Nearby broker.

step three. New Instructor Financial System. This choice is actually owned and you will operated by Ultimate Financing. It can help coaches save very well the realtor and you can closing costs. Yet not, for the majority borrowers, the coupons might not be extremely significant.

People that be eligible for such write-offs typically conserve so you can $800 on every of these expenses. They are already capped during the 0.dos per cent of one’s borrower’s home loan. Quite simply, you’ll you want a mortgage of at least $eight hundred,000 to help you claim a complete $800 real estate agent write off. This particular service can’t be utilized when the a debtor is additionally having fun with a down assistance system.

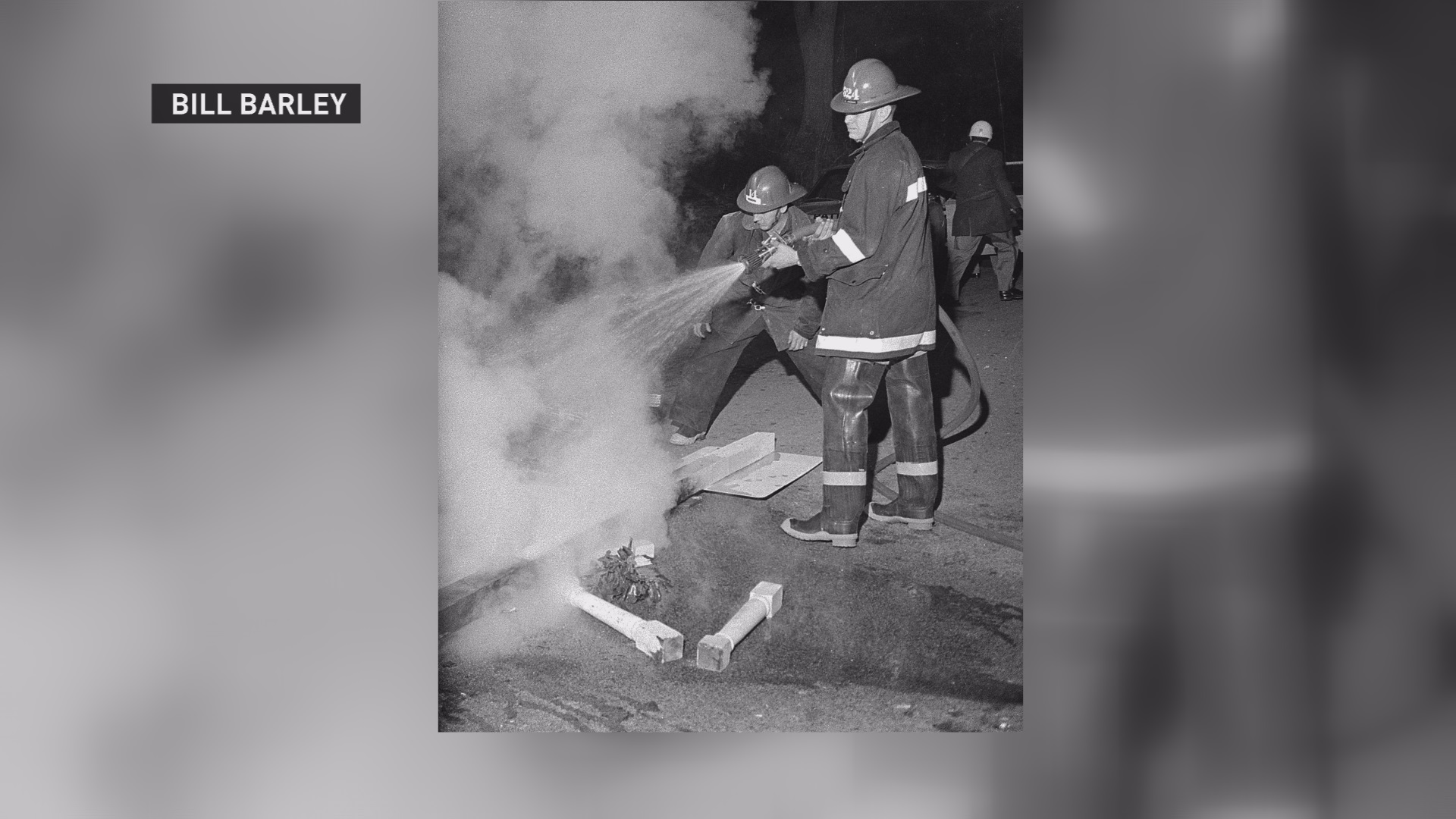

Better home loans having firefighters/first responders

step 1. NeighborhoodLIFT. This specific service is offered from the Wells Fargo. Veterans, cops, and other masters together with very first responders and firefighters can be pertain. Downpayment help of to $15,000 tends to be offered.

Voluntary firefighters, experts, and you will police officers may also pertain. The latest housing marketplace and you may area can impact the fresh new discount that may feel granted. The applying is designed for middle class anyone and you may parents which have reasonable income. If one makes more the funds constraints because of it program, may possibly not be value considering.