Bookkeeping

Average Payment Period: Definition, Formula, and Example

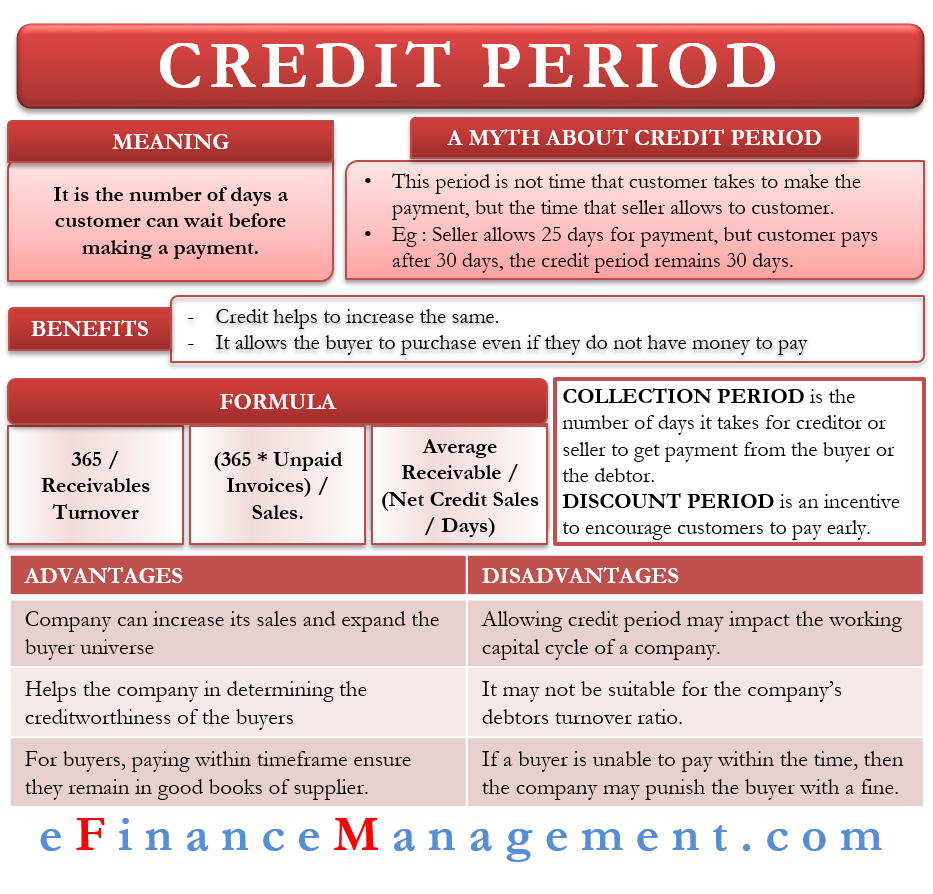

In summary, the average double entry definition serves as an indicator of how efficiently a company leverages its credit advantages to meet its short-term supply needs. If a company’s average payment period is shorter than that of its competitors, it signifies that the company has a higher capacity to repay debts compared to others. The Average Payment Period (APP) is the average time period taken by a company to pay off their dues against the purchases made on a credit basis from the supplier. By computing it, you can assess the appropriateness of your payment terms, credit policies, and choice of business partners.

Disadvantages of DPO

Collecting its receivables in a relatively short and reasonable period of time gives the company time to pay off its obligations. Companies sometimes measure accounts payable days by only using the cost of goods sold in the numerator. This is incorrect, since there may be a large amount of general and administrative expenses that should also be included in the numerator. If a company only uses the cost of goods sold in the numerator, this results in an excessively small number of payable days. Then divide the resulting turnover figure into 365 days to arrive at the number of accounts payable days. A fixed-length pay period is a system where the length of each pay period remains constant throughout the year, regardless of the number of days in each month.

FreshBooks Accounting

Once the repayment period begins, you’ll make full principal and interest payments on the amount borrowed. Change a variable-rate HELOC to a fixed rate for stable monthly payments. This reduces your debt before repayment begins, easing future financial pressure. Reduce HELOC payments by paying down principal during the draw period or refinancing to secure a lower interest rate. It’s entirely possible for fraudulent invoices to be sent in your name, causing significant financial losses for both you and your customer.

- To understand the implications of the payment period and its consequences, we need to look at the payment terms which could deem the result of 38 days as positive or negative.

- At the same time, our platform can automatically process deductions, apply discounts, and chase payments with little human intervention.

- Or you can accept mobile payments with the QuickBooks GoPayment app, which comes with the hardware necessary to accept all major credit and debit cards using just your mobile device.

- Late fees and interest can be strong motivators to getting your invoices paid on time.

- Especially with date-specific and time-sensitive payment terms, sending an invoice to a client immediately is essential.

- Credit is used by many companies as a way of making purchases before they have the actual capital to pay for them.

What are the most common payment terms?

From payment options to early payoff, here’s what you need to know about managing your HELOC effectively. Conversely, if you work with a client who has a perfect track record, you might consider rewarding their timeliness with more lenient terms or even discounts in certain cases. The average collection period does not hold much value as a stand-alone figure. Instead, you can get more out of its value by using it as a comparative tool.

This strategy will offer more convenient options for your customers to close out their purchases and open up a broader market of potential buyers. Of course, not all payment types — and their accompanying processing fees — are equally lucrative for your business. So, while you should offer a broad set of payment options, prioritizing cost-effective channels will benefit your bottom line.

Typically, you’ll only want to offer this incentive for limited periods — particularly when facing a temporary drop in cash flow. Depending on your profit margins, maintaining such a price reduction for an ongoing period could quickly eat into your financial progress and overall business growth. If you choose this approach, clearly document the potential late fee in the initial contract, submitted invoices, and any payment reminders. Consider applying an internal grace period of a handful of days before adding these fees to a customer account to allow for short, unexpected delays.

A higher DPO can suggest efficient working capital management, allowing the company to utilize its cash on hand for longer periods. With multiple pay frequencies available, factors such as your business size, industry, and where you operate can all impact the pay period(s) you choose to implement. But it’s not a decision to make lightly, and you may need help as you weigh your options. Consider using payroll services to help you manage the compensation planning process more efficiently, as well as integrate with other critical HR functions.

From daily and monthly to biweekly and semimonthly, employee pay periods can be tailored to meet the payroll needs of your team and business. All of these decisions are relative to the industry and company’s needs, but it is apparent that the average payment period is a key measurement in evaluating the company’s cash flow management. Calculate credit sales per day– The amount can be calculated by summing total credit purchases in a specific period and dividing by the number of days. The amount calculated with the formula represents the average balance for the period under consideration. It’s an average of the credit purchases and the payments that have been made for the period under consideration. However, some businesses believe in the maintenance of creditworthiness and look for discounts on the early payout.