Bookkeeping

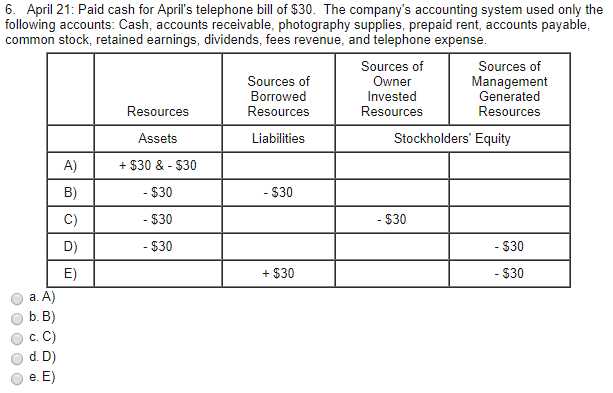

How to Journalize Paying a Bill in Accounting

However, if any costs are incurred as a refundable deposit, it will qualify as an asset. The point that needs attention here is the classification of such deposits. If the refund period is less than 12 months, then it can be part of the current asset; otherwise, it’s a non-current asset. Discover the meaning paid telephone bill journal entry of a journal entry and a trial balance, types of journal entries, how a general ledger differs from a trial balance, and some examples. In this one, both our cash and our liability (accounts payable / creditors) are decreasing. The bill amount is $ 500, and the company manages to pay a week later.

Journal Entry and Ledger Posting for Telephone Expenses incurred but not yet paid

Otherwise, if you’re happy with this lesson, then move on to the next lesson on the journal entry for repaying a loan. The purpose of Adjusting Entries to accrue an expense is to recognize an expense as it occurs. The sum of all such adjustments for a period represent the total amount of expenses accrued by a company.

Accounts Payable Journal Entry Example #2:Paying the Debt

Let’s assume that an employee has made personal phone calls of $20 which are included in the company’s phone bill of $100. Below are two options for recording the cost of the employee’s personal phone calls. Paying employees is often one of the most significant expenses for small business owners. With Hourly payroll software, you can automatically run payroll and calculate related costs, like taxes and workers’ comp—all in one click.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- It might give him a good idea to analyze the unnecessary expenses.

- When the company makes the payment, they have to reverse the accounts payable and cash out.

- Telephone bill and Cash are the two subjects of this transaction.

- Ensure we record amounts accurately and choose appropriate GL accounts to journalize the transactions.

More Examples: Adjusting Entries for Accrued Expense

The trial balance will, of course, have no record of the bill, and yet it would be wrong to ignore the expense involved when preparing the year’s profit and loss account. Accounting is journaling the business transaction to determine a period’s profit or loss. Here’s one example of preparing a journal entry for your payroll expenses. Here are some examples showing the journal entries for some of the more common expenses. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Telephone Charges are recorded by debiting the telephone expenses and crediting the Liability. If the company is able to receive the statement at the month-end, the accountant simply records telephone expenses and cash paid or accounts payable. The expense will be recorded directly into the month in which the service is used.

Journal Entries for Payments on Credit

Businesses track their short-term debts as accounts payable in the general ledger, including the amount owing for their bills payable. Bills payable are the physical bills of sale that request payments by a certain date. In accrual accounting, revenues are matched to the expenses used to generate them, and are recorded when incurred regardless of when cash is exchanged.

The expense (event) has occurred – the telephone has been used in April. It’s pretty common to record the Liability account with the vendor’s name, like the ABC Telephone payable GL account. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. It is important to record the same in the books of accounts to ascertain the true financial position of a company. Bills payable are entered to the accounts payable category of a business’s general ledger as a credit. Once the bill has been paid in full, the accounts payable will be decreased with a debit entry.

If the company receives the invoice during the month, they have to include the expense in the current month. The expenses of a business should be recognized when they incur and not when cash is paid. The expenses are classified into direct expenses, indirect expenses, operating expenses, non-operating expenses, and more. The phone service provider usually sends the telephone bill to the company at the beginning of the month to charge for the previous month’s usage. While some services are able to send the statement at the month-end.