cash and advance near me

??Profit and loss Declaration Loan Program – Unlocking Home loan Recognition for many Entrepreneurs

?Will you be thinking-functioning? And now have come refuted to own a home loan simply because your failed to reveal adequate money in your taxation statements?

However, the new sad simple truth is that lots of banking companies regularly reject mortgage brokers so you’re able to very well really-licensed candidates, simply because of your tax statements. Whenever you are tired of it, and looking for a solution, look no further.

Self-functioning homeowners, rejoice! Here is that loan system that is going to fix this matter to you. It is entitled a profit & Loss Statement Financing. (aka P&L Financing, Profit and loss Loan, Profit-and-loss Report Financial, P&L Financial)

That is A suitable Candidate Having A return And you may Losses Declaration Financing?

This loan program is ideal for business owners, independent contractors, or small business owners who have trouble qualifying for a traditional mortgage loan. It can also be helpful for applicants who may be having a difficult time qualif??ying for non-traditional loan programs like Financial Report Finance or a 1099 Income System.

- Below are a few samples of applicants who can make the most of it program:

- Dollars enterprises

- Businesses that has irregular otherwise inconsistent dumps

- Regular income

- Income that comes out of several higher deposits a year. (for example assets investors or flippers)

- Business owners who had been operating for at least 2 age, Or… come in business for around 1 year with during the minimum 2 years from performs expertise in a comparable occupation just like the your company.

The Profit & Losings Statement Financing Program Functions

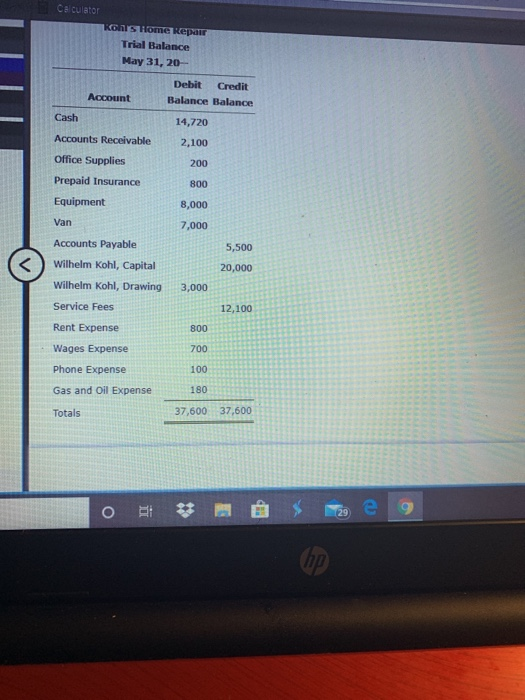

Toward a traditional home loan, the lender requests for significant things, as well as tax statements (team and private), help W2’s, 1099’s, paystubs. nevertheless when you happen to be notice-working or if perhaps you happen to be an independent builder, alot more becomes necessary, such as for instance per year-to-time profit-and-loss statement, harmony sheet, and regularly other financial comments.

The Profit-and-loss Statement Loan System performs in different ways. This is a mortgage that really works literally such as for instance the other customary Financing you’ve got found, Except for one to trick differences: In lieu of with the income shown in your Tax returns— you merely provide us with income and you can Losses Report waiting by the one signed up income tax preparer for latest 2 yrs. The fresh Profit & Losings Report financing does not require any tax returns.

Once we do the terrible earnings without expenditures, we number the online money (immediately following expenses) from this declaration, and you will separate by 2 years, and also the ensuing contour gets the fresh new month-to-month Money that individuals play with to meet the requirements your new loan application.

Yes, its that personal loans in Idaho for bad credit simple—and in addition we discover this process gives us a better idea of your genuine business money vs the newest tax get back approach conventional home loan.

Has actually And you can Benefits associated with An income And you can Losings Declaration Loan System

- 30 Season Fixed Speed Terms and conditions

- 31 Seasons Fixed Speed Words

How to Qualify for A profit And you can Losings Statement Financing

Self-A career Background – To help you meet the requirements, you ought to either An effective) get into organization for at least 24 months Or…B) you truly must be in operation for at least 1 year which have about a 2 year work knowledge of an equivalent community as your company.

If you find yourself care about-working and you have got that it far in business, they didn’t occurs as the you are familiar with providing NO for an answer—very stop permitting such larger finance companies and you can borrowing from the bank unions tell you No, when we have significantly more reasons why you should say Yes.

Check out our Profit and Loss Statement Loan Program Page, or if you have a question you can simply Drop You A column Right here.

Derek Bissen are an authorized Home mortgage Inventor with well over 25 several years of experience in the. Derek is actually a personal-functioning lending professional who’s known for his capability to works having individuals that big wide range and non-traditional credit means. He’s a creative loan structurer and you can focuses primarily on profile credit, asset-situated financing, lender report credit, including traditional financing including Antique, FHA, Va, and you may first-date homebuyers.

Derek’s experience with the mortgage industry is unmatched. They are a dependable advisor in order to their readers, giving them designed loan choice one to fulfill their economic goals and requires. Their big knowledge and experience create him an asset in order to individuals looking to purchase a home or re-finance their existing mortgage.

Since an incredibly-experienced mortgage creator and you may copywriter, Derek try purchased revealing his knowledge with folks. The guy frequently provides rewarding understanding and you will information to clients seeking to browse brand new cutting-edge realm of mortgage credit. Their articles are instructional, entertaining, and you may supported by several years of hand-towards the sense.

Together with insightful knowledge and you will commitment to their customers, he is new wade-to source for all mortgage financing need. If you’re looking to own a trustworthy and reliable home loan pro, contact Derek right now to find out about how he is able to assist you achieve debt goals.