payday loan bank

Why is There a home loan Income tax Deduction?

Mortgage Tax Deduction Calculator

Discover not often much locate enthusiastic about in terms to income tax seasons, with the exception of the awaited output and also the write-offs you could deduct as to the you borrowed from the federal government.

To have homeowners, home loan appeal income tax write-offs is actually a tax season gold liner. From number one mortgage loans to home security-established loans, financial tax deductions are available lower than different home mortgage designs. You can determine your own home loan taxation deductions while they interact with the eye you have paid down strengthening, to get, otherwise improving your household facing their taxable income.

Your house Financing Pro has arrived to guide home owners in order to estimate the mortgage attention deductions they are eligible to discover. We shall take you step-by-step through what a mortgage income tax deduction are, the fresh economic recommendations necessary to estimate the deduction, and you may financial attention deduction limits.

Away from monthly obligations to house repair and you will ownership charges, the menu of quickly-amassed expenses can also be discourage you against wanting to get your fantasy domestic. Home loan attract taxation deductions was basically instated just like the an incentive to get borrowers to get residential property. This is accomplished by permitting you to deduct certain costs your bear in the taxation season from your own taxable earnings. It is popular with home owners who wish to ideal reputation by themselves financially of the reducing the amount of cash they want to pay in taxation.

How can i Estimate My Mortgage Tax Credit?

- Your submitted an enthusiastic Internal revenue service means 1040 and you will itemized your own deductions

- The borrowed funds was a secured financial obligation into the an experienced domestic one you own

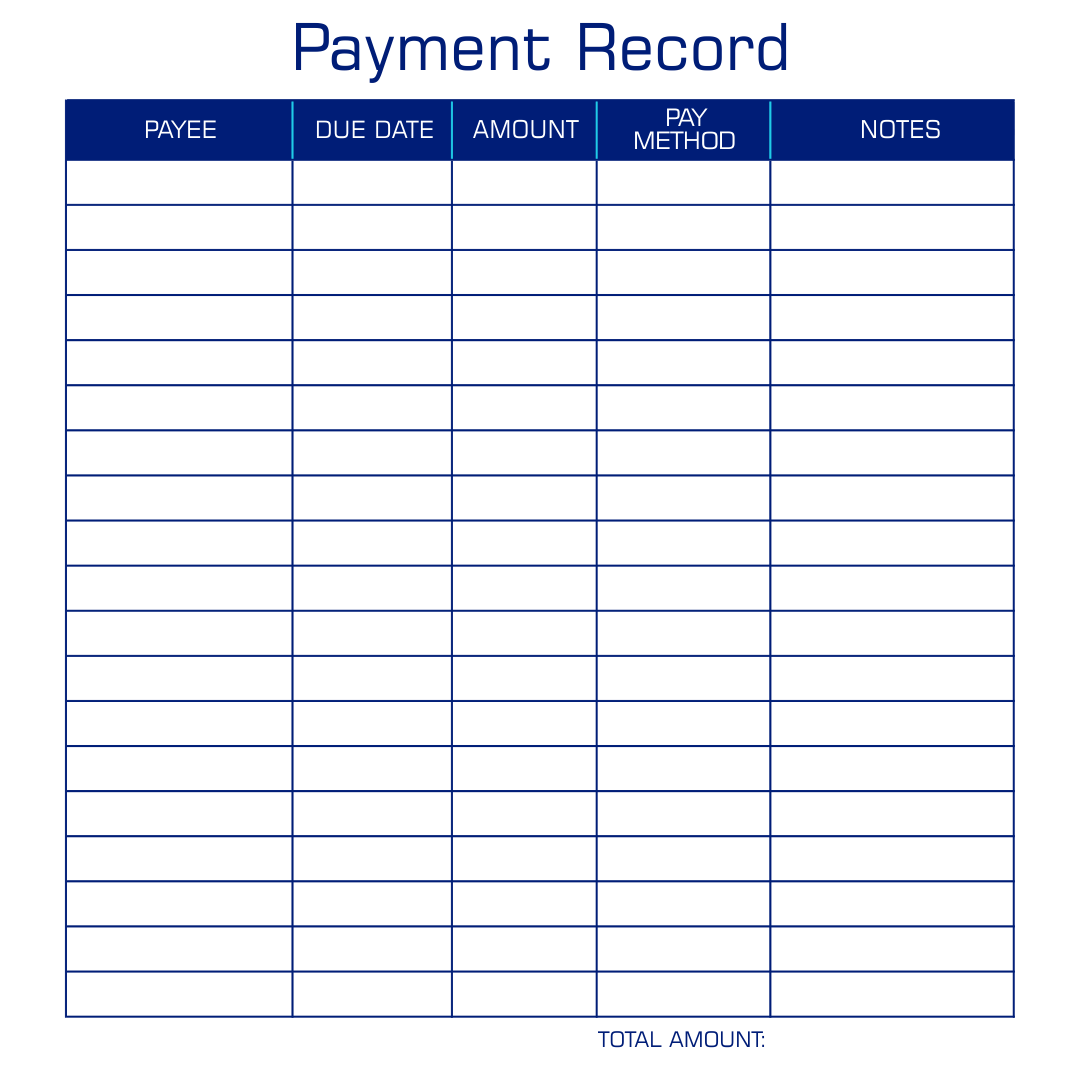

Up coming, just be sure to do some research into the admission sphere below so you’re able to determine their estimated mortgage attention taxation deduction.

- Financial Amount. This is the complete matter your took out for your mortgage loan.

- Mortgage Title in years. Really home loans was issued in the fifteen or 30-seasons name periods.

- Yearly Interest rate. Your own annual focus is based on if for example the rates is restricted or varying. Repaired rates remain unchanged from the longevity of the loan. Variable interest rates reset from time to time during the positioning with markets changes, which can end up in your own rate of interest to improve or decrease.

- Government Taxation Rate. This is basically the marginal government tax rates you would expect to pay based their nonexempt income.

- Condition Tax Rates. Here is the marginal county income tax price you would expect to spend.

- Payment per month. Get into the planned monthly installments because of it enter in. It can were principal, notice, and other charge which can be rolling into your complete homeloan payment.

- Interest rate Immediately following Taxation. This is basically the annual effective rate of interest once taxation try removed into consideration. Its influenced by mortgage debt restrictions.

Lower than 2021’s basic income tax deduction, single tax-payers qualify for a great $a dozen,500 deduction when you find yourself married couples processing combined taxation qualify for a $twenty-five,100 deduction. Note that itemized deductions come under making use of your home mortgage buying, build, or rather change your domestic. You may want to manage to deduct attract towards a property security loan otherwise personal line of credit (HELOC), provided the loan was applied for example of these three motives.

So it calculator assumes on that your itemized deductions have a tendency to go beyond the quality deduction to suit your income tax submitting status. Should your itemized deductions try not to exceed your simple deduction, the benefit of deducting the interest in your family might be reduced or eliminated. Recall if one makes a high money enabling for the itemized deductions as eliminated, your own complete taxation discounts may be reduced.

Were there Financial Interest Taxation Deduction Limits?

Calculating your mortgage attention taxation deduction restrict makes it possible to decide in the event the a standardized or itemized taxation deduction ‘s the best choice for you economically. Brand new TCJA states that there’s a threshold about how exactly far you could potentially subtract. As reported by Irs laws, single-document taxpayers and you will married people processing joint taxes normally deduct home financial desire on the earliest $750,000, or, $375,000 if you’re married however, filing on their own.

To possess property owners who incurred indebtedness ahead of , the maximum financial appeal taxation deduction is set within $1 million to own solitary-document taxpayers and you will ount was faster to $500,000 when you are married however, processing by themselves. Write-offs are also minimal for people who took away a mortgage having causes besides Augusta personal loan to get, make, otherwise alter your house.

How do Your house Mortgage Expert assistance?

A portion of the Financial Expert’s dedication to delivering homebuyers an informed deal it is possible to on their financing also means which makes them alert to tax deductions they can make use of to place on their own better economically. A home loan desire tax calculator is a superb starting place whenever estimating how much you happen to be in a position to subtract of your state and federal taxes this present year. Talking to one of the experienced lending Positives is explain what qualifies as the home financing tax deduction.

We of amicable credit Gurus is selected in the same organizations i suffice. This makes united states used to the clients’ demands and ready to relate solely to what you are experiencing since the homeowners. We know that when it comes to deals, all the bit helps!

So give us a call now during the 800-991-6494 to speak with our experienced financing Positives, that will make it easier to regulate how much you’ll save so it tax 12 months which have mortgage tax write-offs. We could also be reached as a consequence of our very own application to determine if home financing taxation deduction is the most economically strategic option for your private cash today.