cash advance america usa loan

Would you Spend Funding Increases For those who Generate losses towards a good Domestic Sale?

You simply can’t subtract the fresh new loss on the a primary residence, neither can you approach it while the a money losses in your taxes. You are able to do thus, however, into the investment property otherwise rental possessions. Keep in mind that growth from the sale of just one asset shall be counterbalance because of the loss towards almost every other house conversion process, up to $step three,000 otherwise the full websites loss, and you will like loss is eligible for carryover inside then tax decades. For many who offer below-sell to a relative or friend, the order could possibly get topic brand new recipient so you’re able to fees into the differences, that Internal revenue service will get consider something special. In addition to, just remember that , the new recipient inherits your own prices cause for reason for determining any capital gains when they sell, therefore, the recipient should know how much cash you paid down for it, how much cash you allocated to improvement, and you can can cost you out-of selling, or no.

Coach Insight

In addition to the $250,000 (otherwise $five-hundred,000 for a couple) exemption, you are able to subtract the complete cost base on the assets regarding sales speed. The prices foundation try computed by you start with the cost your taken care of our home, after which including buy expenses, particularly closing costs, identity insurance rates, and you can any settlement charges.

To this profile, you can add the price of any enhancements and you can advancements your made with a good life of over one year cash loans in Cullman AL.

In the long run, incorporate your attempting to sell can cost you, eg real estate agent profits and you can attorneys charges, and additionally any transfer fees your sustained.

By the time you find yourself totaling the expense of getting, selling, and you will increasing the property, the financial support obtain to your profit are lower-adequate to qualify for the difference.

The bottom line

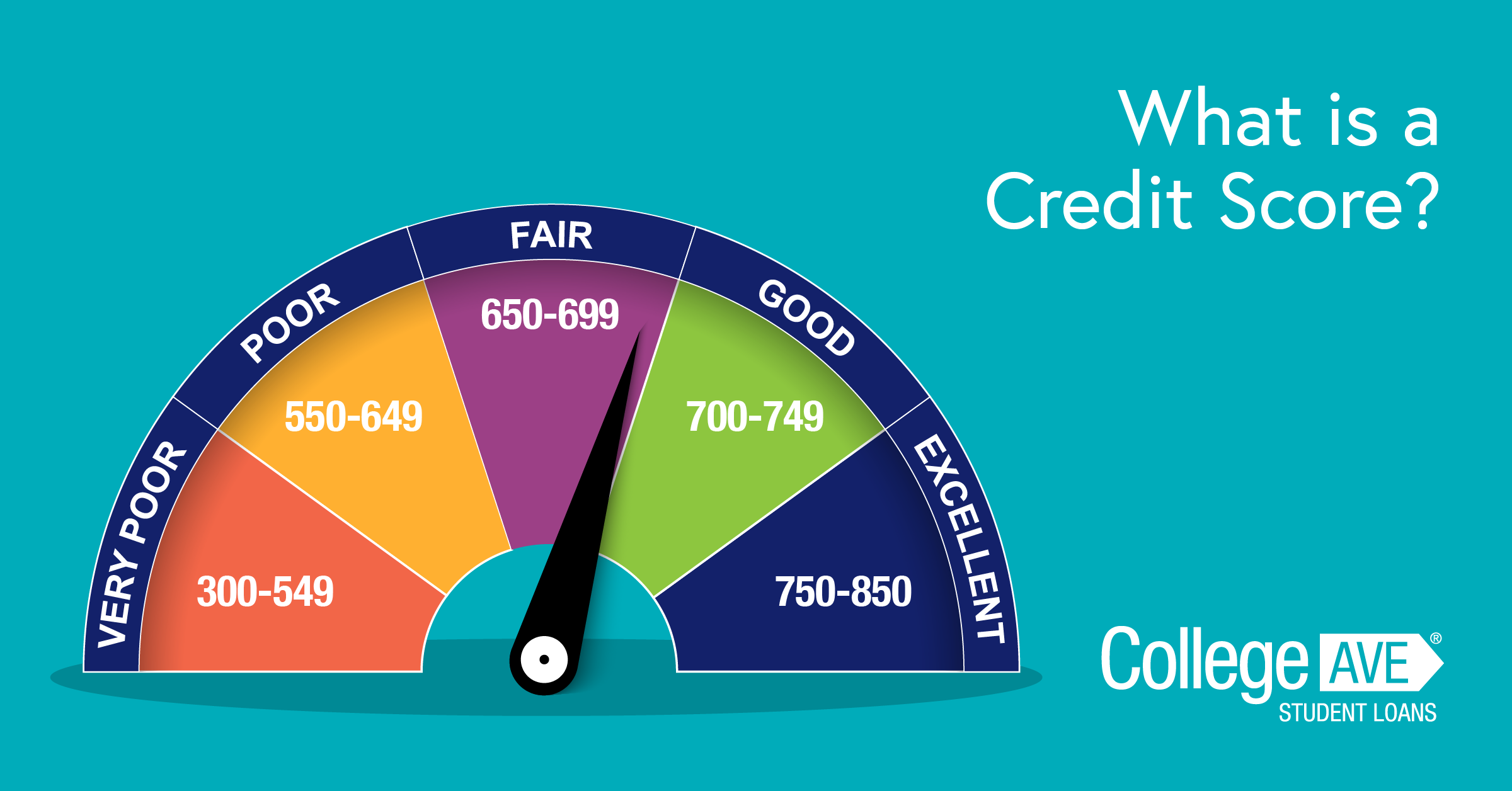

Taxes on the investment increases might be good-sized. Luckily for us, new Taxpayer Recovery Act regarding 1997 will bring certain save so you’re able to people whom see certain Irs conditions. Getting single tax filers, as much as $250,000 of resource growth should be excluded, and hitched income tax filers processing together, up to $five hundred,000 of your money progress shall be omitted. To possess increases exceeding such thresholds, resource growth rates are applied.

You can find conditions for sure things, like breakup and military implementation, together with rules having when conversion should be claimed. Understanding the income tax laws and regulations and you may becoming through to tax alter is make it easier to most readily useful prepare for the new sale in your home. So if you’re in the market for an alternative household, envision researching an educated mortgage rates before applying for a financial loan.

- None the vendor otherwise the later mate took the new exclusion to your an alternative household marketed below 2 yrs till the time out-of the present day domestic sale.

- The house or property was not owned and you may used as the seller’s dominant residence for around a couple of last five years prior for the selling (specific conditions pertain).

Play with 1031 Exchanges To stop Taxation

For each and every commission includes prominent, get, and you may attract, on dominant representing the fresh new nontaxable pricing base and you will focus taxed because the normal money. The brand new fractional part of the get can lead to a diminished taxation compared to taxation to the a lump-contribution go back away from obtain. How long the particular owner retains the property will establish just how it is taxed: for as long-identity or quick-label financial support gains.

Inside the a splitting up, the new companion supplied possession off a property can be matter many years when the family are owned by the previous mate in order to be considered into the explore requirement. Also, should your grantee enjoys ownership in the house, the employment requirement include enough time that the previous mate spends living in the house till the time out-of business.