company loan new payday

What kind of Financial Should i Rating which have an excellent 650 Credit score?

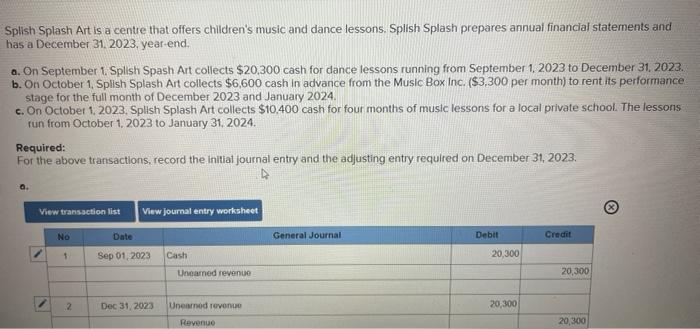

If you are intending with the buying a house, perhaps one of the most vital a few is your borrowing get. A premier credit rating means more loan alternatives and better interest levels, while a decreased credit score you’ll curb your financial selection. Hamilton personal loan with no bank account Thanks to this we ask issue, What kind of mortgage ought i score having an effective 650 credit history?

Good 650 credit rating is the average credit score, and though it could be sufficient to secure a home loan, may possibly not include the absolute most advantageous conditions. Luckily for us, you’ve still got numerous loan solutions for your requirements. Read on to understand your own certain solutions and how to let replace your credit score.

Try 650 good credit?

The top credit bureaus keeps additional credit reporting kinds, and you may a good credit score is actually anywhere between 670 and you will 739. A 650 is found on the latest high-end of one’s reasonable borrowing rating class, and therefore ranges from 580 to help you 669. A beneficial 650 credit rating will assist you to qualify for extremely domestic money, nevertheless may end up with increased interest.

What’s the mediocre financial interest rate that have an excellent 650 borrowing get?

The common financial rate of interest may differ according to your credit score, market standards, income, or other facts. The average individual seeking to a home loan with an excellent 650 credit rating were left with an excellent eight.45% interest rate for the March.

Facts that will determine the type of financial you could rating

Interest rates usually change, but in the modern market, pricing have become a great deal more unstable. You can’t handle the business speed, however, there’s something you have got more control over. These types of activities have a tendency to determine the sort of home loan you might rating.

1. Level of money

Mortgage brokers have payment per month dates. A loan provider should become confident regarding the ability to stay on top of payments, and you will a credit rating alone may well not let them have one to sense. A loan provider usually doesn’t make you financing with an effective $5,000 monthly payment for many who merely secure $cuatro,000 a month at the employment. Which is very risky towards the lender.

2. Most recent loans accounts

Your credit score and earnings height however dont deliver the complete image. On the surface, a borrower and work out $10,000 per month are able to afford a great $3,000 home loan payment per month. However, a lender might get cool ft if this finds out the latest debtor has to keep up with $8,000 per month in financial obligations from other money. The new $step three,000 month-to-month mortgage payments perform grab which individuals expenses so you’re able to $11,000 monthly, and therefore dwarfs the latest $10,000 30 days earnings.

Lenders utilize the debt-to-income proportion to evaluate their chance. A diminished financial obligation-to-income proportion is more good and you can ways the newest borrower keeps significant money left-over out-of for every paycheck immediately following coating their financial obligations.

step 3. Advance payment

Down repayments may help get rid of a lender’s chance. If you buy good $five-hundred,000 possessions in place of while making a down-payment, the lending company try hoping you’ll pay the complete number along with attract. Consumers which make an effective $100,000 down-payment on the same assets only need to compete which have a $eight hundred,000 mortgage equilibrium as well as attract. Insurance firms a reduced add up to acquire, you can acquire a lesser interest rate. An inferior financing equilibrium does mean straight down monthly premiums, that may assist your debt-to-income proportion.

cuatro. Sort of financial

Of a lot consumers ponder whether or not they will be take-out a good 15-seasons or 30-12 months mortgage. Trimming years out of the financial can lead to a lesser notice speed, but you will also have to contend with large monthly installments. Choosing good fifteen-season mortgage are cheaper ultimately since you get free from interest money sooner or later. However, a thirty-year home loan could be more reasonable for your monthly funds and you may will help the debt-to-money proportion.