american advance payday loans

Sort of domestic guarantee finance for less than perfect credit

If you are not yes in which their borrowing from the bank stands, you could potentially demand a free backup of your credit history on the internet. Opinion it cautiously for elements that need work. Seek mistakes, for example incorrect late payments otherwise fees-offs, and conflict them with the right borrowing from the bank agency to probably improve your score.

To help you be eligible for a property security loan, make an effort to keep your DTI no higher than 43%

- Create costs punctually. Also you to overlooked percentage normally drag down your credit rating, thus providing your monthly obligations for the punctually usually help you generate borrowing.

- Pay down existing obligations. Paying off financial obligation, instance charge card stability or other finance, may help reduce your borrowing from the bank utilization ratio. Your borrowing from the bank use is where your primary rotating credit you will be using divided by your borrowing limit. Which have a low credit application proportion shows lenders that one can sensibly manage your expenses.

- Continue elderly membership loans in Excel active. Which adds to the average age of your credit. Since the credit history is the reason 15% of the credit score, a longer credit score is perfect for your get.

- Broaden the borrowing from the bank. Which have a diverse borrowing merge also helps you generate borrowing. In the event the, particularly, you only keeps a credit card, making an application for a small personal bank loan can increase this time of your borrowing from the bank profile.

Think about personal debt-to-money ratio?

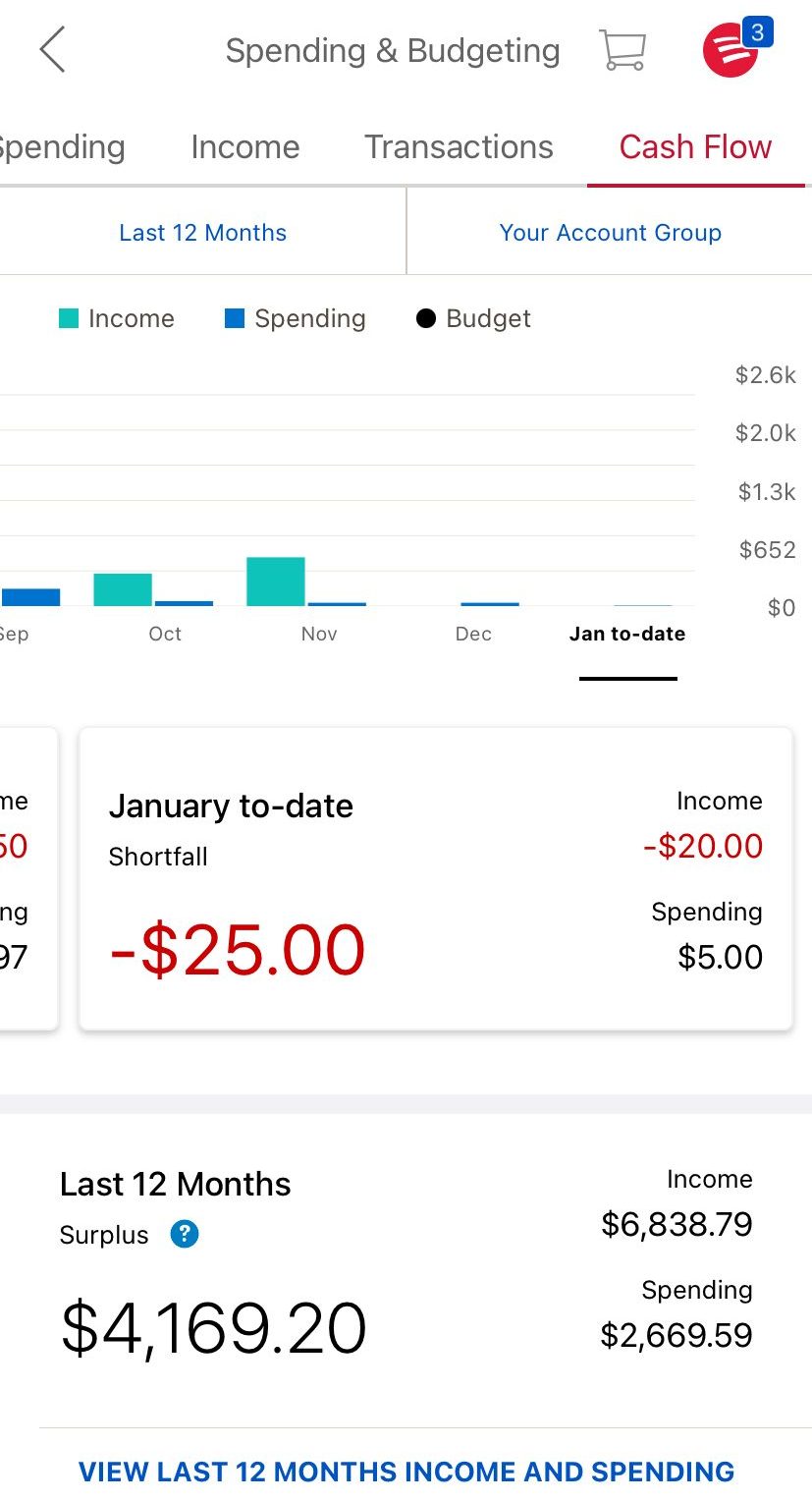

Debt-to-money (DTI) ratio is an additional essential requirement one to loan providers thought whenever deciding if in order to accept the loan software. Your DTI ratio is where much of your month-to-month money goes to the paying present personal debt, conveyed because the a share.

To choose your own DTI proportion, sound right any monthly loans costs, together with college loans, playing cards, mortgage or rent, or child support. Upcoming, separate one amount by the gross monthly earnings.

Eg, state you will be making $cuatro,500 thirty days and you can purchase $dos,five hundred toward debt costs. Your DTI ratio will be 56%.

Whether or not the DTI ratio does not really connect with your credit score, you do not be eligible for investment if your very own is just too highest.

So you’re able to be eligible for a house collateral financing, seek to keep DTI no greater than 43%

- FHA cash-away refinancing: The fresh Federal Housing Management (FHA) cannot render house security financing, although it does give cash-away refinancing. This lets you refinance your home with the more substantial home loan. You’re going to get the difference inside a lump sum that you could explore as you come across fit.

- Subprime household equity financing: These loans typically have reduced stringent lending conditions than just old-fashioned financing, making them far more ideal for less than perfect credit individuals. Although not, they may also come having large interest rates or shorter better fees terms. These finance are safeguarded toward security of your property due to the fact security.

- Unsecured loans having less than perfect credit: Certain banks, credit unions an internet-based loan providers bring personal loans for borrowers which have less than perfect credit. For those who have a reduced credit history, lenders could be worried which you can standard for the repayments. So you can counterbalance that chance, poor credit signature loans commonly have higher rates of interest or reduced installment terms. You may be able to get less interest because of the offering guarantee, just like your household or auto.

- Home guarantee personal lines of credit: An excellent HELOC is a type of revolving borrowing from the bank that one can use out of as required more a set length of time understood because “draw period.” During this time period, you’ll be able to just need to make interest money for the count you use. Because the mark months concludes, it is possible to enter the payment months and come up with normal payments unless you repay an entire count.HELOCs is versatile, however, generally speaking incorporate changeable interest levels, definition your payments will get change through the years. Such investment is also secure by your domestic, you chance to have closing for many who fall behind for the costs.