payday loan need now

What is Apr (Annual percentage rate) And exactly why Can it Amount?

If you have ever taken out a loan or unsealed another type of credit card, up coming Apr (annual percentage rate) are a term you have heard. But what is actually Annual percentage rate? Apr is the speed from which the loan usually accrue attract across the mortgage term.

In this post, we are going to falter all you need to learn, and how Apr really works, just how to calculate they and just why they things.

What is An annual percentage rate (APR)?

Given that title ways, Annual percentage rate are a share one stands for the brand new for every single-title cost of borrowing from the bank currency. Simple fact is that interest you to buyers pay so you can loan providers more living of your financing based on an enthusiastic annualized representation out-of the speed.

Apr comes with your rate of interest and all charges which can was placed on the loan otherwise line of credit at closure. For some financing, this might were any or the following the:

- Foot interest rate: The beds base interest is the speed one a lender costs one borrow funds. Their monthly installments are calculated centered on it rate of interest, which is also used in Annual percentage rate data.

- File planning costs: They are the charges your bank fees you in order to ready your financing.

- Underwritingfees: These fees cover the cost of figuring out if you’re eligible for a loan, such as verifying your credit score, bank statements, income and tax returns.

- Origination fee: This is exactly an over-all term detailed with people fees covering the cost of running your loan software (we.elizabeth., services costs).

- Closingcosts: These are the costs so you can originate your loan you pay from the a home loan closing or roll in the mortgage

Annual percentage rate Compared to. Interest rate

A portion of the difference in Annual percentage rate as well as the interest rate charged to help you financing is the fact that the latter try energized for the mortgage dominant. Because the Apr includes the loan interest together with all of the other fees and you will costs mentioned above, it’s a high percentage. The good news is, you don’t need to value breaking up your instalments ranging from focus and you will Annual percentage rate they truly are paid down simultaneously.

Apr Compared to. APY

Even though they might look similar, it is very important note that a great loan’s Annual percentage rate is not their APY, or yearly commission give. APY is the speed regarding come back you are going to earn regarding a cost savings put otherwise funding.

In place of Apr, it will take under consideration material attract, which is the means of reinvesting a financial investment asset’s income. As a result of this, APY is typically bigger than ount of interest you happen to be getting rather versus interest you have to pay.

How does Annual percentage rate Work?

When you make an application for financing, you will find an installment associated with borrowing from the bank that cash. Apr is the part of attract of these attributes that’s paid back along side life of the loan.

Ultimately, Annual percentage rate is employed because the an informational equipment so you’re able to evaluate offers out-of certain lenders. You need to discover financing towards the lowest Annual percentage rate offer. Funds with a lowered Annual percentage rate can cost you shorter to acquire through the years than just a loan that have a higher Annual percentage rate carry out.

You will http://paydayloanalabama.com/belk/ need to keep in mind that Apr is determined by your credit rating. Just as in very borrowing-associated issues, the greater their get, the reduced the newest Annual percentage rate put on your loan. For this reason, it can be best if you work on enhancing your get before you take away that loan whenever you can afford to hold off.

Because of the Facts in Lending Work regarding 1968, lenders are needed by law to disclose the brand new Annual percentage rate for all the loan they give you before purchase try finalized. This will make it easier for users evaluate APRs because they shop around. The one caveat to keep in mind is that, as the its not all financial boasts an equivalent charges within Apr, you may have to manage a bit more look for the fine print to find the real worth and cost of financing bring.

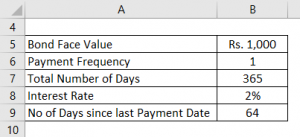

Simple tips to Determine Annual percentage rate Into A home loan

When you find yourself comparing mortgages or finance, it’s best to know exactly how Annual percentage rate are calculated. Having a firm learn of your layout tend to most readily useful tell your look, and it also never ever affects to check on the newest mathematics! Once you learn the level of charges and notice you’ll be likely to spend for the that loan, following deciding the fresh new Annual percentage rate is relatively easy (though it is often sent to you and you won’t ever enjoys to accomplish this):

- Are the fees and you may overall attention are reduced along the life of the mortgage.

- Divide one contribution because of the loan principal.

- Separate you to result by total weeks throughout the mortgage title.

- Proliferate the end result of the 365.

- Proliferate you to definitely of the 100 to find the Annual percentage rate because the a share.