Bookkeeping

What is Job Order Costing? Definition, Importance, Formula

In this scenario, job order costing is a less efficient accounting method because it costs more to track the costs per eight ounces of iced tea than the cost of a batch of tea. Overall, when it is difficult or not economically feasible to track the costs of a product individually, process costing is typically the best cost system to use. Both process costing and job order costing maintain the costs of direct material, direct labor, and manufacturing overhead. In a process cost system, costs are maintained by each department, and the method for determining the cost per individual unit is different than in a job order costing system.

To determine the profitability of the job

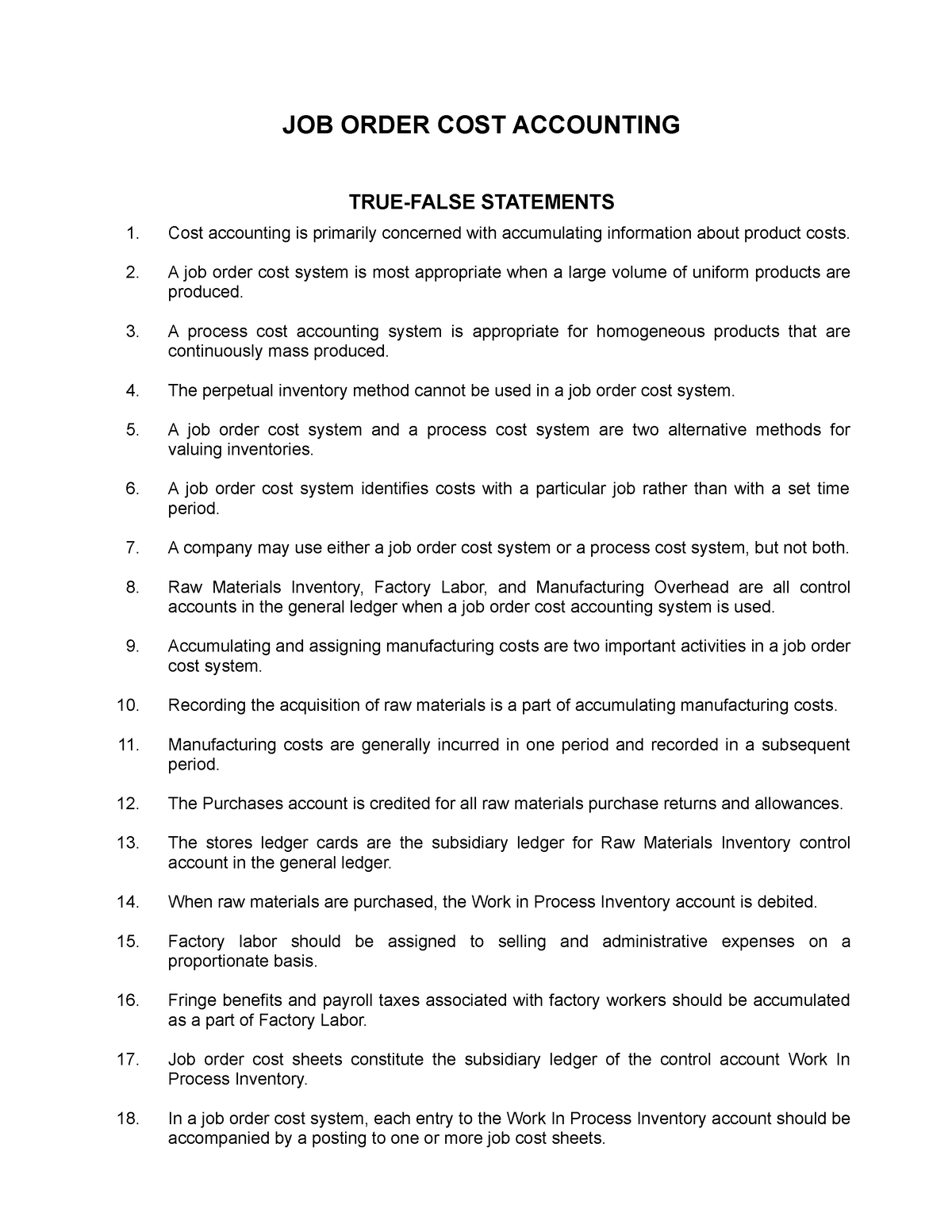

Job order systems are custom orders because the cost of the direct material and direct labor are traced directly to the job being produced. Job order costing is a costing method which is used to determine the cost of manufacturing each product. This costing method is usually adopted when the manufacturer produces a variety of products which are different from one another and needs to calculate the cost for doing an individual job. Job costing includes the direct labor, direct materials, and manufacturing overhead for that particular job. Job order costing tracks prime costs to assign direct material and direct labor to individual products (jobs).

Direct expenses

Over time, a job order costing system becomes a valuable database holding the details and costs of doing jobs. The information that is stored can be used as empirical data to help the company evaluate its own efficiency and reduce costs by changing its procedures, methods, or staffing. For example, some items that are classified as overhead, such as plant insurance, are period costs but are classified lottery tax calculator as overhead and are attached to the items produced as product costs. In the case of a not-for-profit company, the same process could be used to determine the average costs incurred by a department that performs interviews. For example, assume a not-for-profit pet adoption organization has an annual budget of \(\$180,000\) and typically matches 900 shelter animals with new owners each year.

Calculating the costs

Some companies use a single method, while some companies use both, which creates a hybrid costing system. The system a company uses depends on the nature of the product the company manufactures. Job order costing helps you calculate the entire cost of the job in a step by step.

Material cost

If they differ a lot, it means that either your estimation process or your manufacturing process can be improved. Since every cost incurred in this job can be tracked, it is easy to find out where the mistake or excessive consumption has occurred so that it can be rectified. It helps the company make estimates about the value of materials, labor, and overhead that will be spent while doing that particular job.

Fulfill orders more efficiently. Try Zoho Inventory Today!

- Examples of products manufactured using the job order costing method include tax returns or audits conducted by a public accounting firm, custom furniture, or, in a comprehensive example, semitrucks.

- Sometimes, after inspection, the product needs to be reworked and additional pieces are added.

- It includes their wages and any other benefits they are offered while working on the product.

- Each part of the vehicle is mass produced, and its cost is calculated with process costing.

In other words, the cost for this job is assigned based on the costs incurred in the past while doing a similar job. They’re provided as an estimate, and should be adjusted in the final stages of production based on any additional indirect costs which add up during the production process. These costs include the cost of manufacturing equipment, the electricity used to run the equipment, utility bills, and depreciation of machines. You’ll also learn the concepts of conversion costs and equivalent units of production and how to use these for calculating the unit and total cost of items produced using a process costing system.

This helps to remove over or under applied costs and revise them in accordance with the completed job. This step will help identify the true cost of completing the job and arriving at its final cost. Job order costing helps companies see how much they’re using their fixed assets, such as manufacturing equipment. Since machine costs are distributed amongst different jobs, the identification of this cost is important to know the cost of the job. This helps determine the amount of overhead allocated to each asset and distribute it fairly between the company’s jobs.

Job order costing is often a more complex system and is appropriate when the level of detail is necessary, as discussed in Job Order Costing. Examples of products manufactured using the job order costing method include tax returns or audits conducted by a public accounting firm, custom furniture, or, in a comprehensive example, semitrucks. At the Peterbilt factory in Denton, Texas, the company can build over \(100,000\) unique versions of their semitrucks without making the same truck twice. Often, process costing makes sense if the individual costs or values of each unit are not significant. For example, it would not be cost effective for a restaurant to make each cup of iced tea separately or to track the direct material and direct labor used to make each eight-ounce glass of iced tea served to a customer.

This is a very essential step because it helps you decide on an estimate for the job that you will be undertaking. Direct expenses are the costs that can be traced back to the spending of a specific department. These include expenses like design costs, tool maintenance and purchasing equipment that is directly used to manufacture the product. They’re listed under the COGS (Cost of Goods Sold) section in the income statement. In addition to setting the sales price, managers need to know the cost of their products in order to determine the value of inventory, plan production, determine labor needs, and make long- and short-term plans. They also need to know the costs to determine when a new product should be added or an old product removed from production.

If the customer is satisfied with the quote they can place the order and the production can begin. During the manufacturing process, each job is assigned a unique production number and will be identified by this number until the job is completed. Factory overhead is any other manufacturing cost, besides direct labor and materials, incurred during the manufacture of the product. It includes expenses like the electricity bill, janitorial supplies, depreciation of the machines used, depreciation of the land where the manufacturing facility is located, and property taxes.

Process costing also tracks prime costs to assign direct material and direct labor to each production department (batch). Manufacturing overhead is another cost of production, and it is applied to products (job order) or departments (process) based on an appropriate activity base. In job order cost production, the costs can be directly traced to the job, and the job cost sheet contains the total expenses for that job. For example, it would be impossible for David and William to trace the exact amount of eggs in each chocolate chip cookie. Even two sticks made sequentially may have different weights because the wood varies in density. The material cost is the cost incurred for purchasing materials that are essential for the manufacturing process.