elitecashadvance.com+installment-loans-ms+houston my payday loan

Just what a primary-date homebuyer has to be eligible for home financing

First-go out homebuyers have numerous choices to funds the purchase of its basic domestic. Be sure to comment the readily available federal and state apps tailored particularly for very first-big date homeowners, and also the sorts of low down-fee money solutions offered by loan providers, so you can take advantage of the fulfillment off linking basic the place to find very first financing.

Widely known types of home loans available are traditional money. Speaking of funds which might be funded by individual . Certain antique money support a lower-fee as little as step three%. Such finance usually need at least credit rating out of 620 and you may they fees alot more as your credit history drops below 740 or in case the personal debt-to-income (DTI) peak rises. As well as typically would not lend to help you a debtor with a good DTI more than 50%.

FHA Financing Software

The newest Government Homes Administration (FHA) works according to the Company of Houses and Urban Advancement (HUD). Brand new FHA single-family members home loan system will bring accessibility safe, affordable mortgage investment to own Western parents. FHA doesn’t provide currency to help you property owners. Rather, FHA insures accredited finance made by individual credit organizations. FHA usually ensure solitary-household members loans which have down-money as low as step three.5% and also have provides funding to own condos and you can restoration financing. FHA doesn’t need a minimum credit history while offering even more independency in terms of DTI ratios, but private lenders might have their unique criteria. Costs shall be higher compared to old-fashioned financing and you will FHA features a limit into loan amount they are going to insure.

Va Financial Make sure System

Brand new Agencies regarding Experts Affairs (VA) Home elitecashadvance.com/installment-loans-ms/houston/ loan Make sure Program is an additional regulators program one insures certified loans created by private lending organizations. Virtual assistant financing promote zero down-percentage home loan money to eligible pros and you will surviving partners. The fresh Virtual assistant loan represents a selling point of provider and consumers need satisfy Va qualification standards. Va does not have the absolute minimum credit score specifications or DTI ratio, but personal loan providers could have their unique conditions. You will find restrictions toward charges new Virtual assistant debtor can pay with the vendor and you may Va provides a limit toward mortgage matter they ensure.

USDA Rural Housing Loans

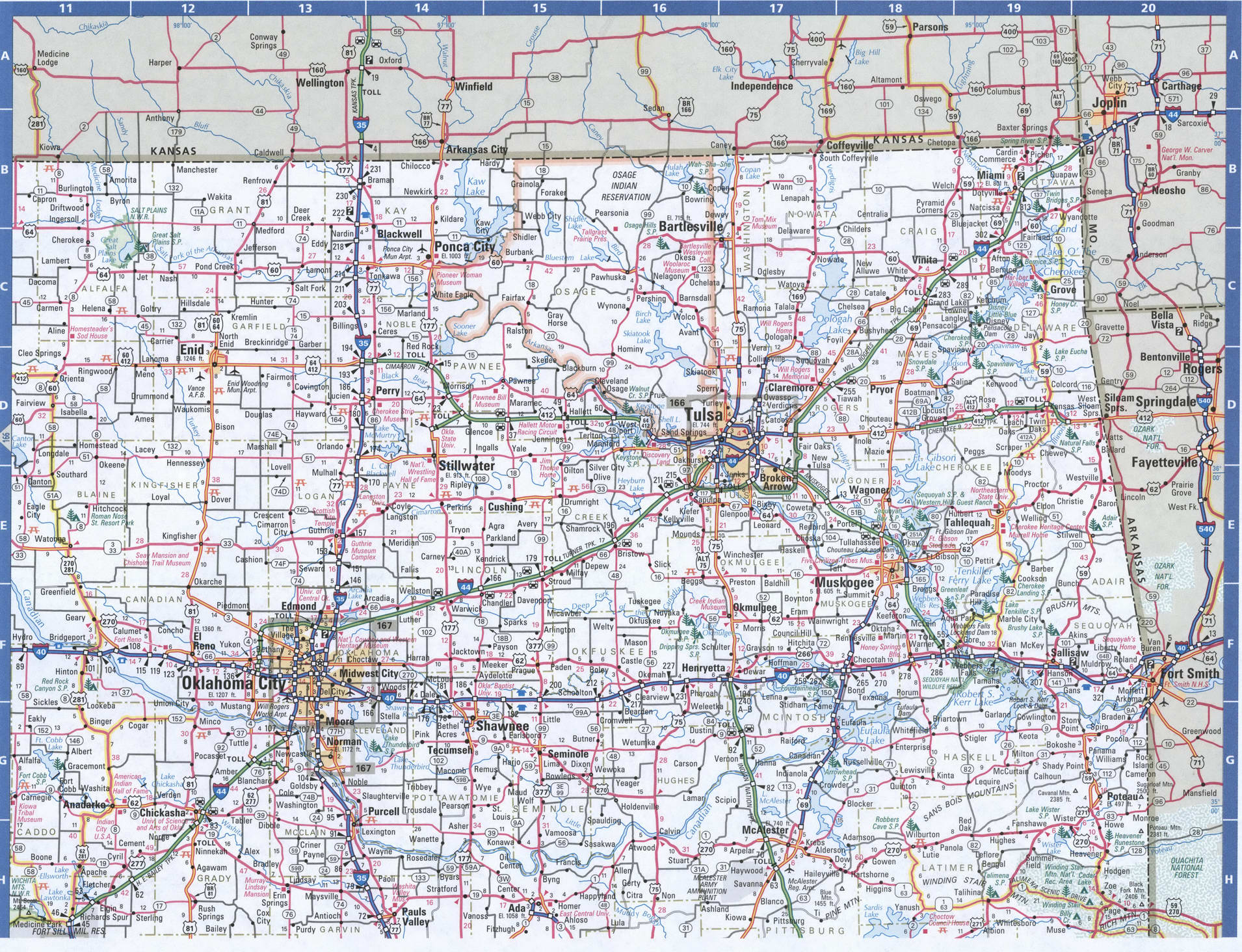

The new You.S. Service off Agriculture (USDA) Rural Houses Services (RHS) also offers Us americans within the outlying section and you may quick towns zero down-payment home loan funding inside the places that personal lending often is restricted. RHS financing are often used to make, resolve, redesign otherwise move in a home, or perhaps to buy and you can get ready web sites, plus getting water and sewage business. There are two main additional apps: the guaranteed system, together with direct financing program. Protected financing is actually covered by the RHS and financed of the private lenders. Direct loans work for extremely-low-money otherwise lowest-earnings borrowers having funds loaned myself by Outlying Houses Provider, without the use of individual loan providers. USDA does not demand the very least credit history requirements however, really does keeps earnings restrictions having consumers.

How to locate mortgage brokers having earliest-go out homebuyers

When thinking about a conventional mortgage tool, remember that many lenders provide incentives having basic-day homebuyers. REALTORS should play with their system out of loan providers and you may mortgage brokers to assist subscribers know latest degrees of offered programs. If possible, give a figures. Remember that with a robust reference to multiple loan providers will assist you render the customer having selection if one lender cannot get the best home loan terms.

You should know that not all loan providers render FHA, Virtual assistant, and even USDA mortgage factors. Make sure to build relationships with lenders that will promote bodies-covered capital to possess website subscribers exactly who love to mention regulators lending applications.

How to locate state-financed has to possess basic-day homeowners

Many says provides applications specifically devoted to let very first-big date homeowners. These types of software include mortgages that have straight down costs and better words than just traditional finance otherwise they may also become assistance with off costs. You really need to contact your nation’s property resource department to ascertain a whole lot more. Very county casing finance organizations is actually independent agencies one to jobs around the new recommendations out of a section off directors designated by for every state’s governor. It administer numerous sensible homes and people innovation programs.

Very, your discover that loan, but still you prefer deposit guidance? Of many local governing bodies and you may non-finances communities render off-payment assistance offers and you can funds, aiimed at area individuals and regularly having certain debtor criteria. Reach out to neighborhood Agent relationship to see if they suggest people certain apps or couples.