paydayloanalabama.com+dadeville my payday loan

Questions to ask yourself just before repaying the mortgage early

How would you utilize the bucks you will be rescuing on the monthly costs?

When you find yourself paying down your financial very early so you can has a great deal more month-to-month cashflow, you’ll have a concept of just how you will use you to definitely a lot more money. If you wish to cut fully out the $900 mortgage repayment and you will dedicate $900 four weeks with its put, that might be a use of the money.

Ultimately, it is your decision simple tips to spend the more income. But if you can’t consider what you should would on money, or if perhaps might spend it for the frivolous orders, settling their home loan very early is almost certainly not the best financial flow.

Why does paying the home loan very early fit into pension bundle?

If you know you want to remain in this household during later years, purchasing it well today so that you don’t have to make month-to-month money from inside the senior years may be the best circulate.

However if you will be, state, a decade regarding senior years and you will haven’t started using yet, expenses was a far greater utilization of the currency than investing off the financial early.

Are you experiencing most other bills to repay?

All round guideline is that you will be run paying down higher-attention financial obligation in advance of lower-appeal loans. You’re expenses a higher rate on the a credit card or personal education loan than on the mortgage, so might work for a lot more by paying the individuals regarding very early.

You should never pay plenty toward your large-notice personal debt that you chance defaulting on mortgage repayments, even in the event. Sure, playing cards will be expensive, as well as the issuer can take suit for those who standard toward credit repayments. However, defaulting towards home loan repayments will be a whole lot larger exposure, since you you will treat your residence.

What other possibilities do you have?

If you are searching in order to sooner or later take back certain area on your monthly funds or spend less on interest, and make most money in your home loan actually your own sole option.

Refinancing helps you reduce your monthly payments, either because of the reducing your price otherwise from the lengthening the loan identity so that you have more for you personally to repay what you owe.

When the repaying your loan very early ‘s the purpose, refinancing for the a shorter title allows you to achieve that when you find yourself spending less to the interest.

If you have a great number of money we should place to your your own financial, you might want to believe a lump sum payment or financial recast.

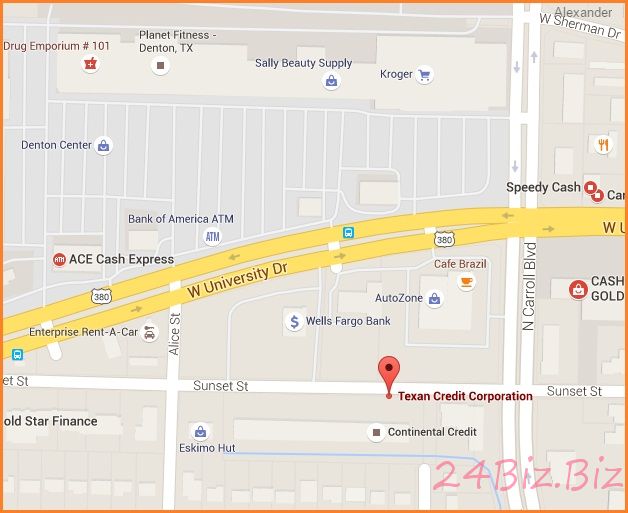

Dadeville loans for bad credit

Having a lump sum payment, you will be making you to large commission for the your principal so that your financial would be paid down very early. But with an excellent recast, you have to pay you to definitely exact same lump sum payment and have the bank estimate exacltly what the monthly payment would be predicated on the new, all the way down prominent number. Then you will have the same term duration but a lower month-to-month fee in the years ahead.

There is no clear proper otherwise incorrect respond to regarding the even though you ought to pay-off their financial early. It depends on your situation along with your individual requires.

Mortgage calculator

Play with the free home loan calculator to see just how settling your own financial early make a difference your money. Plug on your amounts, up coming just click “Additional information” getting information regarding paying even more per month. You may want to explore a formula to figure out your own monthly principal fee, although playing with a mortgage calculator are smoother.

- Hurt your credit score.Several circumstances make up your credit rating, and something is the mixture of credit versions. Including, maybe you have credit cards, auto loan, and you can home loan. By taking aside one type of credit, your credit score commonly drop-off. This ought to be a pretty short drop, however it is something to believe.