Bookkeeping

How to Reconcile in QuickBooks Online

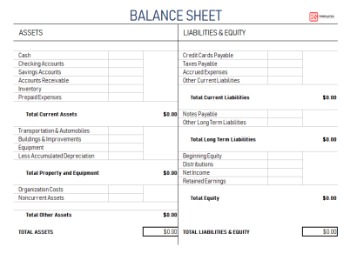

This is useful for comparing the totals in your books to the totals on your bank statement. To complete the reconciliation, make sure the difference shown is zero. Some QBO users assume that reconciling a bank account is when they add or match transactions in the bank feeds window. You cannot reconcile a bank account just by adding or matching transactions.

Investigate Unmarked Transactions on Your Bank Statement

Caroline then patiently explained that they didn’t reconcile QuickBooks Online to their bank statements. In this blog post, you’ll learn how to “really” reconcile your bank accounts (and avoid this awkward exchange with your accountant). I’ll show you how to reconcile bank statements to QuickBooks Online. This section plays a crucial role in identifying any discrepancies between the recorded transactions and the actual account activity. By scrutinizing the checks and payments, any unauthorized or duplicate transactions can be promptly flagged, ensuring the integrity and accuracy of the financial records. The beginning balance serves as the starting point, ensuring that all subsequent transactions are accurately reflected.

Deposits And Additions

It allows for timely identification and resolution of discrepancies, helping to prevent potential financial errors or misstatements. A bank reconciliation report is a crucial document that enables businesses to ensure the accuracy and consistency of their financial records by comparing their internal financial data with the bank statement. This thorough review not only helps in rectifying the discrepancies but also plays a vital role in maintaining accurate financial records. Duplicate transactions can distort the actual financial position and lead to misinterpretation of the company’s financial health.

Step 5: Click On “Run Report”

By setting the date range accurately, users can obtain a clear overview of their financial activities, making it easier to detect any discrepancies or errors. This helps in ensuring the accuracy and integrity of the reconciliation process. This selection allows users to focus specifically on banking-related activities and transactions, making it convenient to track and reconcile their financial records. Upon choosing the ‘Banking’ category, users can further refine their report options based on their banking needs, such as viewing transaction details, reconciling accounts, or tracking deposits and withdrawals. By navigating through this process, users can efficiently generate comprehensive banking reports to gain insights into their financial activities and streamline their reconciliation procedures within Quickbooks Online.

A tour of the bank reconciliation window in QuickBooks Online

If you use accounting software, then your reconciliation is done largely for you. However, as a business owner, it’s important to understand the reconciliation process. Triple-check the statement balance, service charge, and interest income you entered from the bank statement. Make sure the service charge and interest income are only entered during the reconciliation if they aren’t already cost recovery methods in QuickBooks. You’ll want to look at your statement, starting with the first transaction listed and find that same transaction in the Reconciliation window in QuickBooks. If not, you’re most likely looking at an error in your books (or a bank error, which is less likely but possible).

Duplicate transactions can distort the accuracy of records, the issuance of notes and bonds leading to misrepresentation of financial positions. Verifying balances helps to identify any discrepancies between the bank statement and the Quickbooks Online records, ensuring that the financial data is reliable for decision-making. Making adjustments based on these checks helps in rectifying any errors and aligning the records accurately.

- Once you have selected all the transactions, the difference on the upper-right should be zero.

- Make sure you’re using the very first bank statement for that account.

- If you have been at it for a while and you need a break, QuickBooks allows you to pick up where you left off.

- These situations can seem like major problems, but there are solutions which I will go over in future blog posts.

- When looking at the reconciliation window from this perspective, it looks similar to the banking center (bank feeds).

QuickBooks has built-in compatibility with time-tracking and payroll. Employees log their hours, you review and cash flow statement operating financing investing activities approve them, and QuickBooks does the rest. Cut checks or pay employees via direct deposit, issue W2s at tax time, and file taxes electronically – all from QuickBooks. So, what if a bank account has never been reconciled in QuickBooks Online? These situations can seem like major problems, but there are solutions which I will go over in future blog posts.

When looking at the reconciliation window from this perspective, it looks similar to the banking center (bank feeds). The main difference is that there are a few more columns that we need to pay attention to. We’re here to helpIf you’ve got any questions or need a hand fixing a connection error, linking or reconciling a bank account, let us know.